There are a lot of questions in the real estate market right now. Is the market crashing because of inflation and high mortgage rates? Why are mortgage rates so high and will they ever come back down? Is now a good time to sell a home? Should home buyers wait until market conditions improve?

We’re hearing these questions every day, so we thought it would be a good idea to share a comprehensive market update. This will be a multiple-part series on The Cyr Team Blog, so stay tuned for upcoming articles. In this post, we would like to focus on how the market has gotten to the point where it is now. We will review which factors have led to low inventory in recent years. We will talk about the after-effects of Covid on the real estate market, as well as how high inflation and mortgage rates are impacting the business as a whole.

Population—Generational Home Ownership

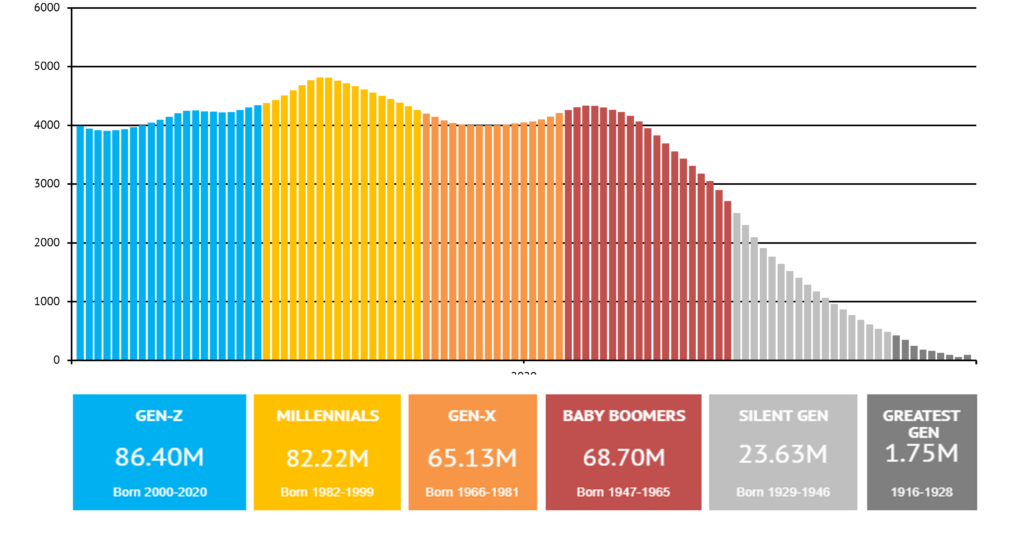

Approximately 78% of baby boomers (people born between 1947-1965) are homeowners. Compare this to today’s younger generations. Only 34% of people between the ages of 20-34 are homeowners. This is no surprise there are fewer younger people who own homes. However, they are entering their prime buying years. They are driving demand for housing.

Unfortunately, there aren’t enough homes to go around. Millennials and Generation Z together represent approximately 51% of the U.S. population. Baby boomers only make up 21% of the population, yet they own a majority of the homes and they aren’t in any rush to sell. They are comfortable where they are, having paid off their homes completely or enjoying low interest rates from refinancing or their original purchases. The demand for new housing is there, but the inventory is not.

Inventory

Speaking of housing inventory, it’s easy to understand why there is not enough supply to meet buyer demand. The Great Recession of 2008 severely damaged the new home construction industry. Many builders went out of business and those that stayed around slowed production. Based on average population growth, there should be about 1.5 million new homes built each year to keep up. The new construction numbers between 2012-2019 were much lower than that, which led to a weakened inventory long before Covid hit and shook up the market even more.

Even as new construction numbers have risen significantly in recent years, we’re still a long way from supply matching demand. It has been a seller’s market and it will continue to be for the foreseeable future.

Mortgage Rates

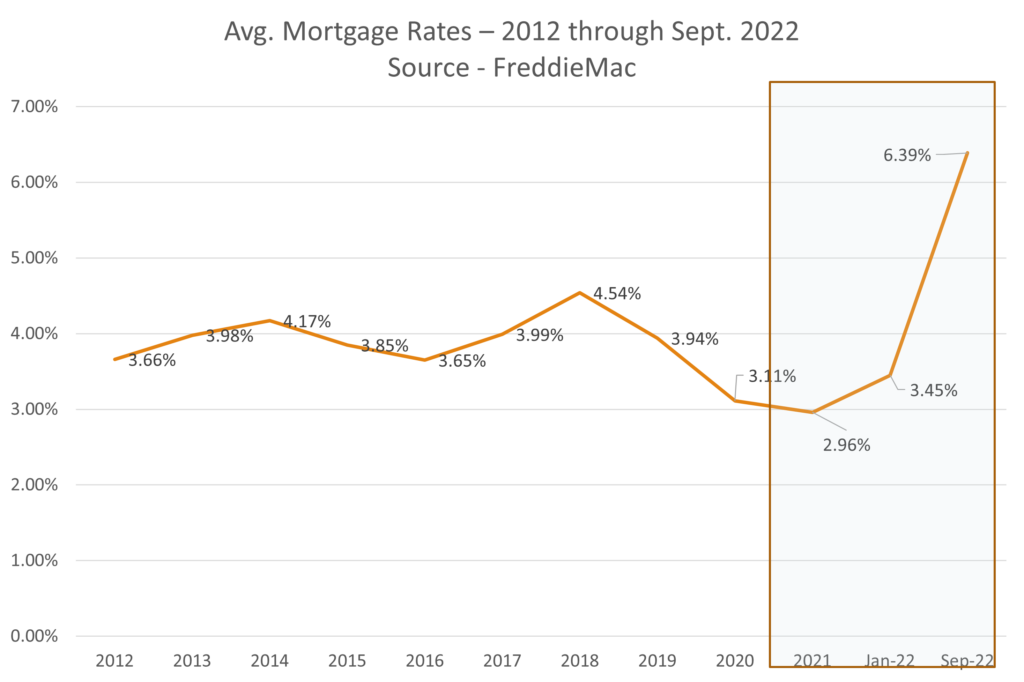

During this same period after the last recession, mortgage rates remained fairly steady. The lending qualification standards were much higher after the sub-prime bubble burst, but risk for lenders was greatly reduced. This resulted in a very stable mortgage market.

Things changed dramatically in the mortgage industry after the Covid pandemic swept the world. The government poured a lot of extra money into the economy in various forms: stimulus payments, PPP loans, mortgage forbearance, rental moratoriums, etc. The Federal Reserve also lowered the Fed Rate and other unique economic factors contributed to the lowest mortgage rates we’ve seen in decades.

Low mortgage rates and extra available money made it cheaper to get loans, thus making homes more affordable for buyers—even as home prices kept going up rapidly. Many sellers opted to leverage their home equity and refinance at these historically low rates rather than sell. This made for a very competitive marketplace. Any house on the market was easier to sell. Multiple-offer situations were common and buyers were willing to concede certain items just to get the houses they wanted. These low mortgage rates simply weren’t sustainable because they were artificially created by the government’s economic recovery efforts.

As mortgage rates have gone back up to well over 6%, buyers have become more cautious. Loan money isn’t quite as cheap as it was a couple years ago. The market is still driven by low inventory, but buyer demand has slowed. Home prices are continuing to go up. However, the rate of appreciation is lower than it was. In 2022, we still expect an overall appreciation of 10% nationwide, though most of that happened in the first quarter of the year.

Covid Effects

Buyers were driven more by emotional decisions during the Covid-19 pandemic. Many people thought their way of life was changing permanently and this led to some rash decisions. Homeowner priorities revolved around remote work opportunities, being closer to family (or considering multi-generational living solutions) and being less location-oriented. They moved away from the cities and their job-adjacent locations in search of greener pastures.

There was a ton of frantic real estate activity happening throughout 2020 and well into 2021 as both buyers and sellers were making big moves. Still, it was more buyers taking action than sellers. Many opted to stay where they were and ride it out.

Inflation Effects

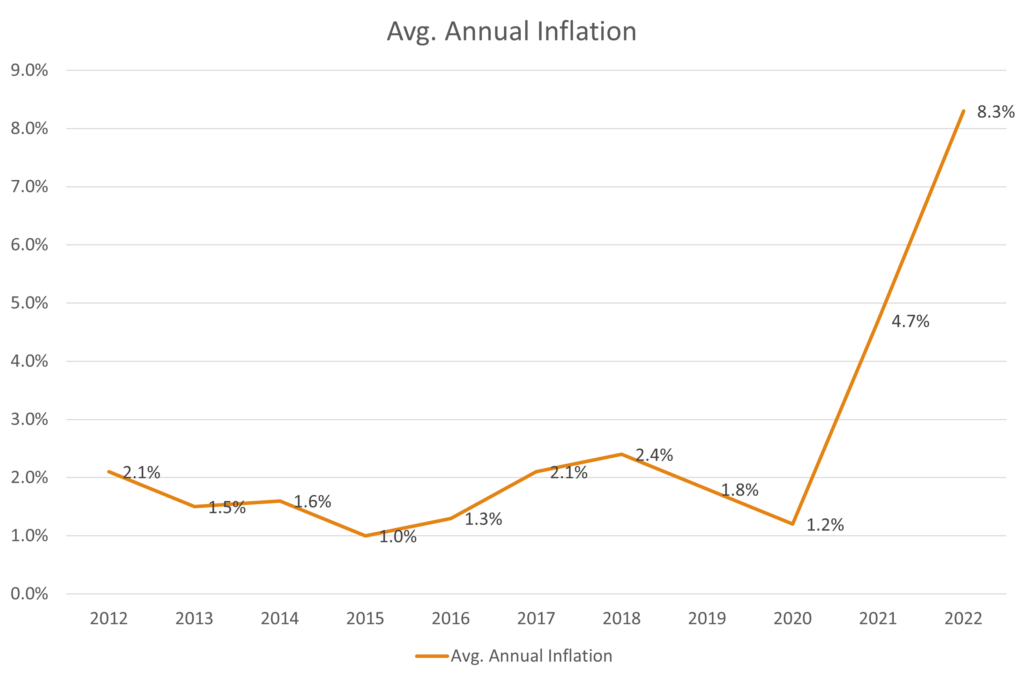

2020 saw a very low inflation rate of 1.2% during the craziness of the pandemic. 2021 saw a significant inflation rate of 4.7%. 2022 is on pace for a jaw-dropping inflation rate of 8.3%.

We always like to say inflation is “too much money chasing too few things.” In other words, it takes more money to buy the same amount of goods and services. Home buyers have less buying power because of this and high mortgage rates make the lending money even less affordable. They have to be smarter with their purchases.

Both home buyers and home sellers in today’s real estate market must reset their expectations. Homes will still be bought and sold, and sales will still be happening. This provides some perspective on how we’ve gotten to where we are today in the real estate and mortgage industries.

In our next article, we will discuss the expectations that today’s buyers and sellers need to have. We will talk about how to make the right real estate decisions and what you can do to prepare for your next move.

If you have questions about real estate in the Southeastern Pennsylvania and Northern Delaware areas, contact The Cyr Team today for an introductory home buying or selling consultation.