Retirement may be many years away for some of you. For others, it is just around the corner. We can’t tell you when to retire or how to save money for retirement. However, where to retire is a question we do get asked from our real estate clients from time to time.

Where Do You Want to Move?

We have helped many empty-nesters sell their houses in our local market. Some buy smaller places in the same area. Others are preparing to move to a different state. We recently came across an interesting article on WalletHub about the best states to retire. We wanted to share these rankings and provide a little insight of our own.

Keep in mind this is just one author’s research and ranking system. If you are thinking about moving out-of-state, you should take your own time to research. Understand state income and property tax laws, figure out what you can afford and scout where you would like to live. Moving to a new area is a big deal, especially if it’s where you intend to spend your golden years of retirement.

How Rankings Were Determined

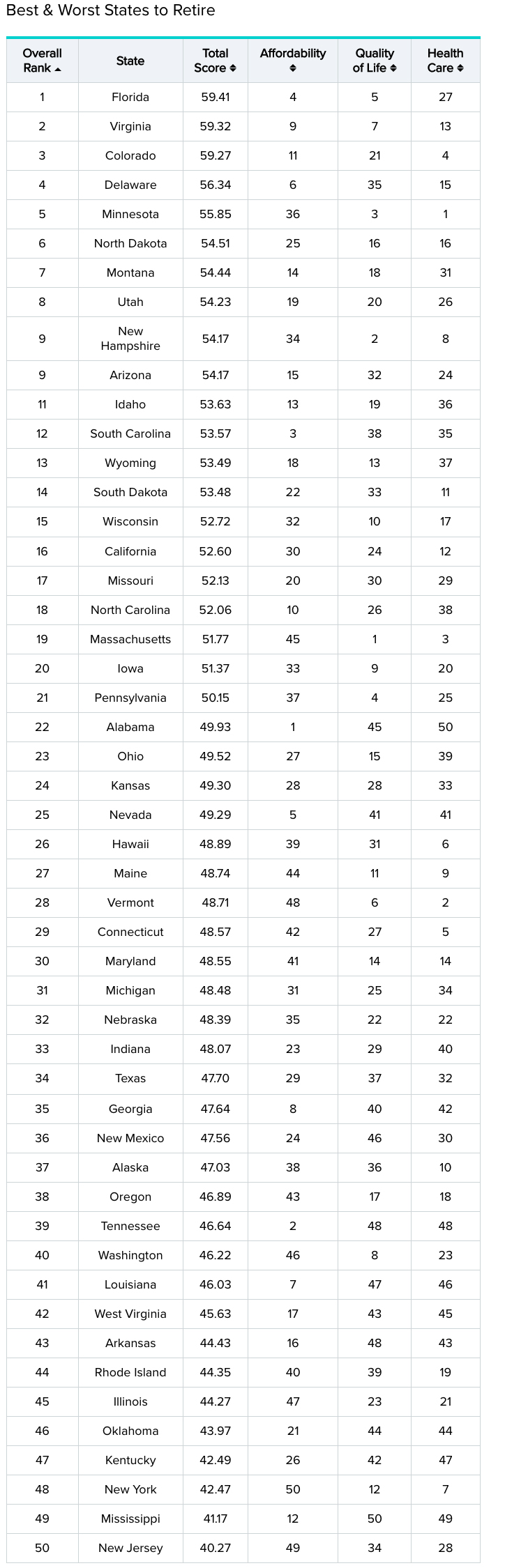

The researchers behind this article used 47 indicators to create their overall rankings. Three of the key indicators (affordability, quality of life and healthcare) are featured on the master list below. Not surprisingly, Florida ranks as number one. It has always been the country’s most popular retirement destination and their data seems to back it up. Virginia was a close second and Colorado was right there in third.

When you delve deeper into the key indicator rankings, however, you’ll find that Florida offers great affordability (#4) and quality of life (#5), but ranks in the middle of the pack for healthcare (#27). You may love the tropical climate, favorable taxes and affordable housing down there, but you may want to rethink that move if healthcare is your top priority.

Coming in fourth on the overall list is Delaware, which is a market we serve. It doesn’t rank as high for quality of life (#35), but does average well for affordability (#6) and healthcare (#15). Our other local markets don’t rank quite as well. Pennsylvania is 21st on the list and New Jersey is dead last at 50th. That doesn’t mean these are bad places to retire. Every retiree will have different priorities and preferences.

Here is the map and full list:

Do Your Own Research and Planning

Perhaps these kinds of lists will influence a decision or make you rethink a destination (good or bad). You should always take this research with a grain of salt. You can find other similar rankings where the lists are completely different. For example, this article from Bankrate lists Georgia as #1.

What matters most is you choose a retirement location that is right for your budget and lifestyle. Then, it’s important to plan your move well before you actually hit the road. Get your finances in order and get your home ready to sell. Talk with a local real estate professional about selling your current house, but also be working with a Realtor® in your new area who will help you with your next purchase. If you can afford both properties at the same time, that may make your move go a lot smoother. If you can’t, then consider renting in your new location for awhile until the right retirement property comes along. Otherwise, timing a home purchase, home sale and big move simultaneously can be stressful and complicated. This is why planning and preparation are so beneficial.

If you are looking to buy or sell a home in Southeastern Pennsylvania or Northern Delaware, contact The Cyr Team today. If you are buying in a different area, we can also connect you with top-notch Realtors across the nation. Let us do the vetting for you!